If you are looking for what is Atal Pension Yojana or its premium chart information etc., then you have come to the right place. In this article you Atal Pension Yojana Chart information, through which you can know that you How much will you invest for a fixed pension every month,

Before you proceed with the plan, you should know important information – retirement planning should know about.

because Atal Pension Yojana a purpose of For a simple life for a person who has retired Get a fixed amount every month.

What is Retirement Planning

You have worked hard to create a life for yourself and your family that is full of dreams, achievements and happiness. Now, as you near retirement, you may have new dreams and goals in mind.

After retirement, a certain amount may be needed to fulfill some small and big dreams and live life with your loved ones. To get this fixed amount, you need Retirement Planning.

With the help of a little retirement planning, you can fulfill your desires while maintaining your financial freedom.

Retirement Planning This is a type of self financing planning, in which you estimate the maximum investment according to your Retirement Goal, so that you can get the flow of a certain amount per month.

You… Yourself retirement savings There are many ways of planning can be done to increase it, such as;

- Savings Account or Fixed Deposit

- equity or fund investment

- Investment in Government Guaranteed Pension Scheme

Since we will give you Atal Pension Yojana which is a type of retirement pension scheme, for this we will provide you information related to this Atal Pension Yojana and how to make the best investment using its chart.

What Is Atal Pension Yojana 2024-25 [Hindi]

APY 2024-25 This is a type of government pension scheme, which is completely focused on the employees of the unorganized sector (such as construction workers, well diggers, carpenters, painters, electricians and dam managers etc.)

Under this scheme, you will receive a guaranteed minimum pension of Rs 1,000/- or 2,000/- or 3,000/- or 4,000 or 5,000/- per month at the age of 60, depending on your contribution/investment.

financialservices.gov.in के अनुसार: इस Atal Pension Yojana को सभी भारतीयों, विशेष रूप से गरीबों, वंचितों और असंगठित क्षेत्र के श्रमिकों के लिए एक सार्वभौमिक सामाजिक सुरक्षा प्रणाली बनाने के लिए 9 मई 2015 को शुरू किया गया था। APY को पेंशन फंड नियामक और विकास प्राधिकरण (PFRDA) द्वारा प्रशासित किया जाता है।

When this scheme was started, the government had announced co-contribution for 5 years to add citizens to the scheme.

Government co-contribution was available for 5 years i.e. 2015-16 to 2019-20 for the subscribers who joined the scheme between 1st June 2015 to 31st December 2015. [अब सह-अंशदान निरस्त कर दी गयी गयी है ]

Scheme Eligibility

Any citizen of India can join the APY scheme. Following are the eligibility criteria:-

- The age of the subscriber should be between 18-40 years.

- He should have a Savings Bank Account / Post Office Savings Bank Account.

- Not taking benefit of Employees Pension Scheme (EPS).

- You are not a tax payer. That means your minimum annual income is not 2.5 lakhs.

Benefits of APY

- Employees of public and private sector can join the scheme.

- Unorganized sector employees can join the scheme.

- Guaranteed pension is available under the scheme.

- You also get tax exemption under the scheme.

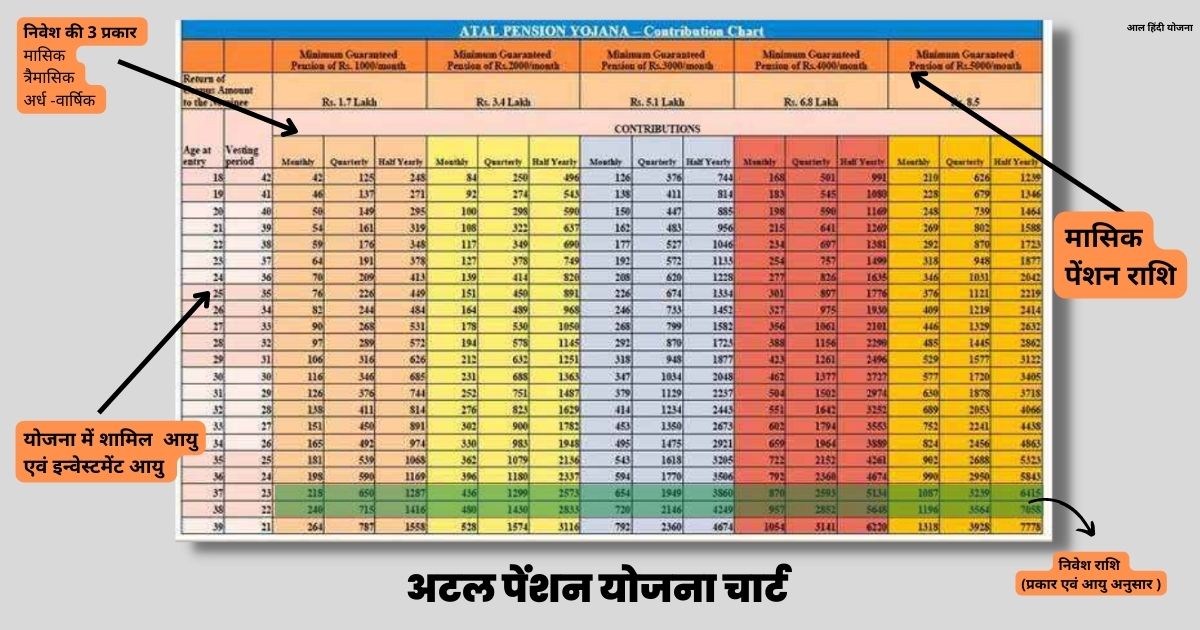

Atal Pension Yojana Premium Chart 2024 (APY Chart)

Atal Pension Yojana chart this one Monthly Pension Vs Contribution Chart Is. That is, you get an idea from this APY Chart that if you want to get a certain monthly pension, then how much amount you will invest in the scheme after applying for that.

A minimum monthly investment of Rs 1000 to Rs 5000 can be obtained in this APY scheme. There are three types of investment (contribution) that can be made under the scheme:

- monthly

- quarterly

- Half yearly (six monthly)

You can get information about entry age, monthly, quarterly and half-yearly investment, minimum pension etc. in the Atal Pension Yojana Chart.

Individuals in the age group of 18-40 years can join the scheme and invest under it till the age of 60. The amount you want to invest is shown in this APY chart.

APY Premium Chart (Monthly by Investment Type)

| age of joining | The age by which you will invest | Rs 1000 Investment to be made every month to get monthly pension (Rs) | Rs 2000 Investment to be made every month to get monthly pension (Rs) | Rs 3000 Investment to be made every month to get monthly pension (Rs) | Investment to be made every month to get Rs 4000 monthly pension (Rs) | Investment to be made every month to get Rs 5000 monthly pension (Rs) |

|---|---|---|---|---|---|---|

| 18 | 42 | 42 | 84 | 126 | 168 | 210 |

| 19 | 41 | 46 | 92 | 138 | 183 | 228 |

| 20 | 40 | 50 | 100 | 150 | 198 | 248 |

| 21 | 39 | 54 | 108 | 162 | 215 | 269 |

| 22 | 38 | 59 | 117 | 177 | 254 | 292 |

| 25 | 37 | 64 | 127 | 192 | 254 | 318 |

| 24 | 36 | 70 | 139 | 208 | 277 | 346 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 26 | 34 | 82 | 164 | 246 | 327 | 409 |

| 27 | 33 | 90 | 178 | 268 | 356 | 446 |

| 28 | 32 | 97 | 194 | 292 | 388 | 485 |

| 29 | 31 | 106 | 212 | 318 | 425 | 529 |

| 30 | 30 | 116 | 251 | 347 | 462 | 577 |

| 31 | 29 | 126 | 252 | 379 | 504 | 630 |

| 32 | 28 | 138 | 276 | 453 | 551 | 689 |

| 33 | 27 | 151 | 302 | 414 | 602 | 752 |

| 34 | 26 | 165 | 330 | 453 | 659 | 824 |

| 35 | 25 | 181 | 362 | 495 | 722 | 902 |

| 36 | 24 | 198 | 396 | 543 | 792 | 990 |

| 37 | 25 | 218 | 436 | 594 | 870 | 1087 |

| 38 | 22 | 240 | 480 | 654 | 957 | 1196 |

| 39 | 21 | 264 | 528 | 792 | 1054 | 1318 |

| 40 | 20 | 291 | 582 | 873 | 1164 | 1454 |

Understand the use of APY Premium Chart with an example

you this Atal Pension Yojana Chart Let us see, if you are eighteen years old, and join the scheme, then how much will you have to invest to get a fixed monthly pension.

for example

After joining the scheme, you will be at the age of 60. To get Rs 1000 monthly pension you in the following way minimum investment have to do:

- monthly Rs 42 contribution of

- quarterly Rs128 contribution of and

- half yearly Rs 248 contribution of

Atal Pension Yojana Related FAQs

This Atal Pension Yojana providing monthly guaranteed pension was launched on 9 May 2015. The center of this scheme is to provide a fixed pension facility for the unorganized sector employee in his retirement.

> Atal Pension Yojana Chart is important, because through this chart you can do your retirement planning according to your age.

>You can decide how much you need to invest in APY for a fixed monthly pension if you are 60 years old.

- सीएनजी पंप डीलरशिप ऑनलाइन आवेदन CNG Pumps Dealership Apply

- विश्व मलेरिया दिवस पर निबंध

- Superset Login Student Registration @joinsuperset.com Hiring 2023

- (पंजीकरण) कृषि इनपुट अनुदान योजना 2023- Krishi Input Anudan Yojana

- फक्त 5 हजारांच्या हप्त्यात येईल 36kmplमायलेजची कार! मेंटेनेन्स दरमहा 400 रुपये

- TN e sevai Login, Status, tnsevai.tn.govt.in