Term vs Whole Life Insurance: Which is Best for You?

Term vs Whole Life Insurance | Life insurance is a crucial aspect of financial planning, providing financial security for loved ones in the event of an untimely death. Among the various options available, term life insurance and whole life insurance stand out as two primary choices. Understanding these options is essential for making informed decisions that align with your financial goals and family needs. This article will delve into the differences between term and whole life insurance, helping you determine which is the best fit for you.

2. Understanding Life Insurance

Life insurance is a contract between an insurer and a policyholder, where the insurer provides a death benefit to beneficiaries in exchange for premium payments. Key terms to know include the premium (the amount paid for coverage), death benefit (the amount paid upon the insured’s death), and beneficiaries (the people who receive the death benefit). Life insurance plays a vital role in financial planning by providing a safety net for dependents, covering debts, and ensuring financial stability.

3. Term Life Insurance

Term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years. It provides a straightforward and affordable way to secure a death benefit.

- Types of Term Life Insurance:

- Level Term: The premium remains constant throughout the term.

- Decreasing Term: The death benefit decreases over time, often aligned with a mortgage.

- Renewable Term: The policy can be renewed at the end of the term without reapplying.

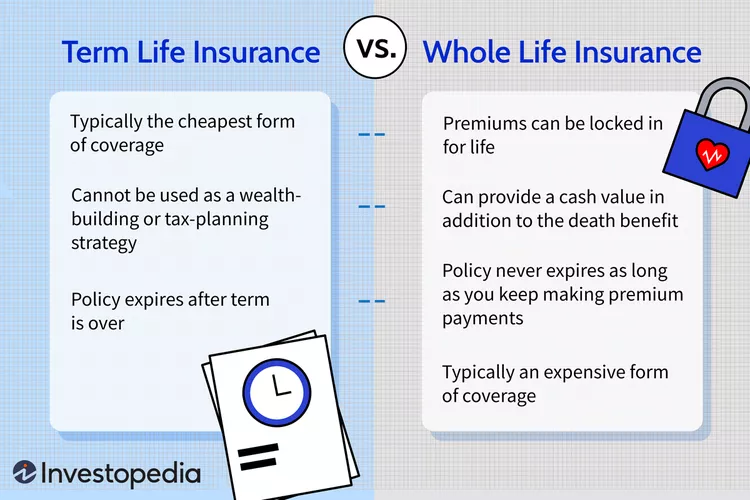

Advantages of Term Life Insurance:

- Affordability: Generally cheaper than whole life insurance, making it accessible for many families.

- Simplicity: Easy to understand with straightforward terms.

- Flexibility: Allows for coverage adjustments as financial needs change.

Disadvantages of Term Life Insurance:

- No Cash Value: Unlike whole life policies, term policies do not accumulate cash value.

- Temporary Coverage: If the policyholder outlives the term, the coverage ends without any return on premiums.

- Potential for Higher Costs Over Time: Renewal premiums may increase significantly.

4. Whole Life Insurance

Whole life insurance provides lifelong coverage and includes a cash value component, allowing policyholders to build savings over time.

- Cash Value Component: A portion of the premium goes into a cash value account that grows over time, providing liquidity and potential borrowing options.

- Types of Whole Life Insurance:

- Traditional Whole Life: Fixed premiums and guaranteed cash value growth.

- Universal Life: Flexible premiums and death benefits with cash value accumulation.

- Variable Life: Investment options that allow for growth based on market performance.

Advantages of Whole Life Insurance:

- Lifetime Coverage: Provides coverage for the policyholder’s entire life.

- Cash Value Accumulation: Acts as a savings account that can be borrowed against or withdrawn.

- Predictable Premiums: Premiums remain stable, aiding in long-term financial planning.

Disadvantages of Whole Life Insurance:

- Higher Premiums: Typically more expensive than term life insurance, which may not fit every budget.

- Complexity: Understanding all the features can be challenging.

- Limited Investment Options: Returns on cash value are often lower than other investment vehicles.

5. Cost Comparison

The cost of life insurance varies based on factors such as age, health, lifestyle, and the type of policy.

- Average Costs:

- Term life insurance tends to be significantly cheaper than whole life insurance, especially for younger individuals.

- Whole life insurance, while more expensive, provides lifelong coverage and cash value benefits.

Assessing Affordability: When deciding between the two, consider your current financial situation and future goals.

6. Which Policy is Right for You?

Choosing between term and whole life insurance depends on various personal factors:

- Age: Younger individuals may benefit more from term policies due to lower premiums.

- Financial Goals: Consider whether you need temporary coverage or a lifelong financial tool.

- Family Situation: Families with dependents may prioritize term insurance to ensure financial protection during critical years.

- Risk Tolerance: Assess your comfort level with potential investment risks associated with whole life insurance.

Situations Favoring Term Life Insurance:

- Young families seeking affordable coverage.

- Individuals with temporary financial obligations.

Situations Favoring Whole Life Insurance:

- Those looking for lifelong coverage and cash value accumulation.

- Individuals seeking to leave a financial legacy.

7. Real-Life Scenarios

- Case Study 1: A young couple with children opts for a 20-year term policy to cover their mortgage and education expenses.

- Case Study 2: An individual nearing retirement chooses whole life insurance to provide lifelong coverage and an inheritance for their children.

- Case Study 3: A business owner takes out a whole life policy as key person insurance, ensuring business continuity and protection for their family.

8. Expert Opinions and Insights

Financial planners recommend assessing both personal needs and long-term financial goals when choosing between term and whole life insurance. Insurance experts suggest considering term insurance for its affordability and straightforward benefits, especially for those just starting in their financial journey.

Common Misconceptions: Many believe whole life insurance is the only way to secure a legacy; however, term life can also provide substantial benefits depending on the situation.

9. FAQs About Term and Whole Life Insurance

- What is the main difference between term and whole life insurance?

- Term insurance provides temporary coverage for a specific period, while whole life insurance offers lifelong coverage with a cash value component.

- Can you convert term life insurance to whole life insurance?

- Many term policies offer conversion options, allowing you to switch to whole life coverage without additional health assessments.

- How do I determine how much life insurance I need?

- Consider factors such as your income, debts, dependents, and future financial goals to calculate your insurance needs.

10. Conclusion

Understanding the differences between term and whole life insurance is essential for making informed financial decisions. Each policy type has its own advantages and drawbacks, catering to different needs and financial situations. Ultimately, consulting with a financial advisor can help you assess your specific circumstances and make the best choice for your future.

Call to Action

Don’t leave your family’s financial future to chance. Take the time to evaluate your life insurance options and seek professional guidance to ensure you choose the best policy for your needs.