If your total income is more than Rs 2.5 lakh, then in such a situation you come under the tax net. you for income tax return file is necessary. How much tax has to be paid depends on your income and your age as well as the tax regime you have chosen. ITR is filed from 1st April to 31st March of every financial year. If you file your ITR after this, you will have to pay late fee for the same.

Today we are going to tell you in the article what is Income Tax Return i.e. ITR? And How to file ITR online (Income Tax Kaise Bharte hain) Will inform about it. How to file Income Tax Return online and how many types of ITR form are there? Read the complete article for all the details.

Know this also – Now farmers will get loan up to 5 lakhs to buy vehicles

What is ITR? What is ITR

Individuals falling under the income tax category have to file ITR between April 1 and March 31 every financial year. Often you must have heard that I have to file my ITR after that otherwise I will have to pay late fee. But do you know what is ITR after all? And is it necessary for everyone to fill it? And what is the benefit of filing ITR? If you also want to know the answers to such questions, then this article is for you only.

income tax return which ITR known as. it’s kind of tax return form It happens. in this form income tax department It is used by tax-paying individuals, organizations, etc. to report their assets or their income. This form contains complete details of personal and financial data of taxpayers. Let us tell you that the taxpayer does not have to attach any document while filing income tax. The ITR filed by the taxpayer is e-verified with the OTP received using his mobile number or internet banking.

Read this also – What is OPS and NPS, know the complete information from here

Key Highlights of Income Tax Return

| article name | What is ITR? How to file ITR online? What are the types of ITR forms? |

| relevant department | Income Tax Department, Government of India |

| Purpose of Income Tax Portal | To facilitate citizens for online services related to income tax |

| Year | 2024 |

| Income Tax Department Official Website | incometaxindia.gov.in |

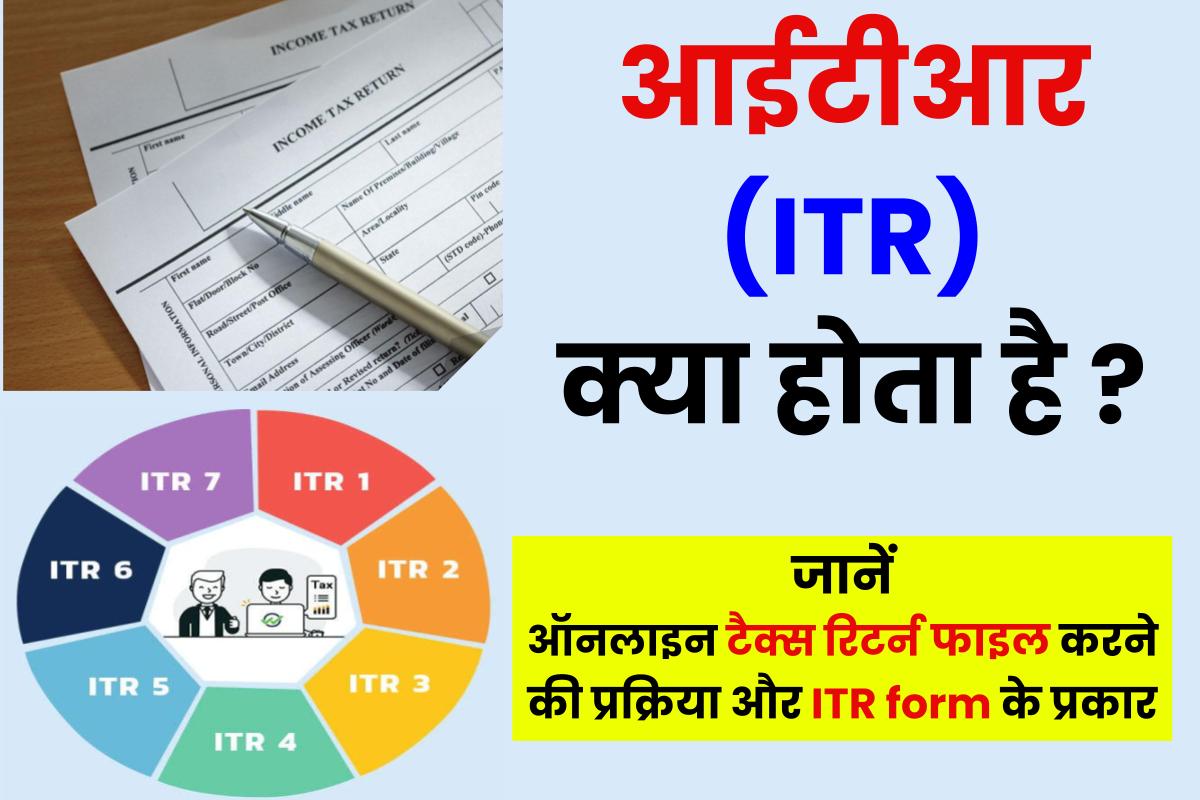

What are the types of ITR forms? Types of ITR forms

You will get to see many forms of Income Tax Return on the official website of the Income Tax Department. These ITR forms are used to file ITR based on different income and tax paying taxpayers. In the assessment year 2024-25, forms from ITR-1 to ITR-7 have been made available to you on the website of the Income Tax Department. But here it is necessary to know which ITR form will be right for you according to your category –

| Form Number/Type (ITR Form Number) | form for |

| ITR-1 | to ITR Form No. 1 Simple Known by name. Most of the people file their income tax returns through this form (ITR Form-1). income tax file We do. This form is to be filled by such citizens whose income is through their salary / salary, house property or interest / interest. And whose total income is up to Rs.50 lakh. |

| ITR-2 | This forms to be filled by persons who hindu undivided families are from Those who have income but that income is not earned from any business or profession. |

| ITR-3 | person who huf means hindu undivided families and derives income from any business or any profession. |

| ITR-4 | ITR Form No. 4 is to be filed by individuals who have an estimated income from business or profession. |

| ITR-5 | ITR-5 The form is filed by all such persons who are not in the following categories – Individuals, Hindu undivided families, companies and individuals who ITR-7 are filing. |

| ITR-6 | ITR Form No. 6 is to be filled by all such companies which are not exempted under section 11 of Income Tax. |

| ITR-7 | ITR Form No. 7 is applicable for all such companies and such persons who are liable to pay tax under section 139(4A), section 139(4B), section 139(4C), section 139(4D), section 139(4E) or section 139(4F). It is necessary to file ITR under |

Know this also – Kisan Credit Card Scheme 2024

Documents required to file Income Tax Return

You will need the following documents to file ITR –

- PAN card

- Interest certificate from banks or post office

- Bank statement

- Form 16 for such persons doing job.

- Proof of Tax Saving Investments

- salary slip

- tds certificate

- Form 26AS

- Form 6A/16B/16C

How to file ITR online?

Taxpayers can easily file their income tax return through online medium. For this, you have to keep the necessary documents like Aadhaar card, PAN card, Voter ID card with you. Now you have to file ITR online by following the steps given below –

- First of all, you have to file or file income tax return on the official website of the Income Tax Department. incometax.gov.in Visit on

- As soon as you reach this website, the home page of this website will open on your screen.

- If you are filing ITR for the first time then you have to first register yourself on the website.

- For registration, you will get the option of register on the home page itself. You have to click on it.

Step-2 Login to the website

- If you are already registered on the portal then you have to login (You will find the option of LOGIN on the homepage of the website at the top and on your right hand side)

- on the website LOGIN Click on the button. The login page will open in front of you, enter your User ID and Password here.

- As soon as you are logged in you will see in the menubar on the screen e-file The tab will appear you have to click on it.

- as soon as you ‘e-file’ Let’s click on the tab below it you will getFile Income Tax Return’ You get the option, you have to click on it.

- Now on the new page assessment year (Assessment Year) to be selected whichever year you ITR file want to do now you online Mode has to be selected.

- anymore continue button is to be clicked.

- Now you have to choose your category from here; As

- If you are an individual, select Individual

- Select this if from Hindu Undivided Family (HUF)

- If want to file ITR in other form personal Select the option.

- Now as soon as you choose your category, after that you have to Filling Type going into 139(1)- Original ReturnThe option has to be selected.

STEP-3 CHOOSE YOUR ITR FORM

- Now on the basis of your category you will have to “ITR Form” have to choose. And proceed with ITR 1 Click on

- after that now you income tax return file The reason for doing so has to be filled.

- After this, you have to fill the information related to your bank account. If you have already filled the bank account information, then you will have to click on the option of pre-validate from here.

- Now a new page will open on your screen. this page income return file Where some information will already be entered.

- You have to check these information and return summary confirmed Have to do it and get it validated.

- You can electronically send the signed printout of ITR V to cpc Bangalore with the help of Aadhaar OTP or Electronic Verification Code. tax return verification can do.

- Now as soon as you file your tax return ITR V You will receive the receipt on your email.

- As soon as ITR V is verified, further processing will be started by the Income Tax Department. You will get its information on your registered mobile number or email.

Also read – How to open GST Suvidha Kendra

ITR Form-1 Sahaj Format

Income tax rates for the financial year 2024 -24

The income tax rates for the assessment year 2024 -24 are as follows –

| range of income | income tax rates |

| 50 lakh to 1 crore | 10 percent |

| 1 crore to 2 crore | 15 percent |

| 2 crore to 5 crore | 25 percent |

| 5 crore to 10 crore | 37 percent |

| more than 10 crore rupees | 37 percent |

Income Tax Slab Rate FY 2024 -25

| income tax slab | Applicable to all individuals and Hindu Undivided Family |

|---|---|

| Rs 0.0 – 2.5 lakh | no tax |

| Rs 2.5 Lakh – Rs 3.00 Lakh | 5% (Tax exemption is available under section 87A) |

| Rs 3.00 Lakh – Rs 5.00 Lakh | |

| Rs 5.00 Lakh – Rs 7.5 Lakh | 10% |

| Rs 7.5 Lakh – Rs 10.00 Lakh | 15% |

| Rs 10.00 Lakh – Rs 12.50 Lakh | 20% |

| Rs 12.5 Lakh – Rs 15.00 Lakh | 25% |

| above Rs.15 lakh | 30% |

Helpline Number / Contact Details

| Aayakar Sampark Kendra Number (general queries related to income tax Helpline Number) | 1800 180 1961 1961 |

| e-filing and Centralized Processing Center (e-Filing of Income Tax Return or Forms and other value added services Refund and other Income Tax Processing Related Queries helpline number) | 1800 103 0025 1800 419 0025 +91-80-46122000 +91-80-61464700 |

| Tax Information Network – NSDL (Helpline number for queries related to PAN and TAN Application Issuance Update) | 91-20-27218080 |

| Email ID for information related to income tax return (For ITR 1 to ITR 7) | [email protected] |

| Email ID for information related to Tax Audit report (Form 3CA-3CD, 3CB-3CD) | [email protected] |

Important Links

Also read – How to complain about income tax evasion

Frequently asked questions (FAQs) related to Income Tax Return-

To fill Income Tax Return (ITR) online, you have to visit the official website of Income Tax India Filing. First of all you have to login on this website. After this, you have to click on “e-file” on the dashboard of the website, then click on “Income Tax Return” and file income tax return and select ‘Assessment Year’. Now choose the type of your tax return and complete the further process.

According to the new rules, now senior citizens above 75 years of age whose source of income is pension account of the bank and interest from bank account, those people do not need to file ITR.

Different Income Tax Return Forms are filled by taxpayers of different categories of ITR. ITR Form-1 is filled by most of the taxpayers. This form is filled by such individuals whose income is less than 50 lakhs.

ITR Form-1 is filled by those taxpayers when their income from salary, house rent and other income sources together is less than 50 lakhs.

ITR is filed from 1st April to 31st March every financial year.

Related Posts –

- सीएनजी पंप डीलरशिप ऑनलाइन आवेदन CNG Pumps Dealership Apply

- विश्व मलेरिया दिवस पर निबंध

- Superset Login Student Registration @joinsuperset.com Hiring 2023

- (पंजीकरण) कृषि इनपुट अनुदान योजना 2023- Krishi Input Anudan Yojana

- फक्त 5 हजारांच्या हप्त्यात येईल 36kmplमायलेजची कार! मेंटेनेन्स दरमहा 400 रुपये

- TN e sevai Login, Status, tnsevai.tn.govt.in